Uzbekistan’s economic reform and development are different than in other countries of Central Asia. The country’s initial, post-independence policy was mainly based on gradual economic reforms, which allowed it to mitigate the negative effects of the collapse of the Soviet Union and maintain higher economic growth rates. Initially, dependent on raw materials exports such as gold and cotton, Uzbekistan’s authorities decided to make its economy independent and self-sustainable. Industrial policy played a key role in achieving these goals.

According to Bae and Mah (2018), after the mid-1990s the government adopted a strategy to transform the economy from heavy dependence on agriculture and natural resources to a modern industrial economy. Instead of experiencing rapid deindustrialization, Uzbekistan conducted an industrialization policy, which had three aspects. First, the government tried to reduce its heavy reliance on the production and export of cotton and to achieve self-sufficiency in food by increasing grain production. Second, it pursued self-sufficiency in energy to become a net fuel exporter. Finally, it tried to increase the share of industry in GDP and that of machinery and equipment in both total industrial outputs and exports. Uzbekistan’s government has taken industrial policy measures, including tax and financial incentives, state orders, a policy selectively welcoming FDI, protection from import and promotion of export, and exchange-rate management.

According to the Strategy of Development of New Uzbekistan for 2022-2026, to accelerate the development of the national economy and provide high growth rates, the country’s industrial policy aimed at increasing the share of industry in GDP and the volume of industrial production by 1.4 times. Within the Strategy, Uzbekistan planned to liberalize energy markets, organize copper industry clusters, and develop the chemical and gas chemical industries, bringing the level of natural gas processing from 8 to 20%. Furthermore, the government planned continuing localization efforts in the auto industry with an increase in production volume by 1.4 times and its export by 2 times. It was expected that an industrial cluster of agricultural machinery would be created; the volume of leather and footwear and pharmaceutical industries production would increase by 3 times. The electrical industry production was planned to double and exports to triple (President.uz, na). Later, Uzbekistan adopted the Strategy – 2030, where the previous goals were adjusted and updated. In particular, by 2030, the country plans to increase the share of industrial-technological products from 25 to 32%. At the same time, the country’s labor productivity processing industry will be doubled. Uzbekistan will create a competitive environment in the automotive industry and increase production volume to 1 million cars. Moreover, the government will organize 8 research and production clusters in the areas of metal processing, mechanical engineering and electronics, transport and logistics, and agricultural productivity and yields. According to expectations of the government, more than 30 prestigious foreign brands to the leather and footwear industry will be attracted and added value will be increased by 5 times. Finally, the government aims to bring value added in the industry to $45 billion and create 2.5 million high-income jobs (Lex.uz, 2024).

Indicators of industrial development in Uzbekistan show promising results. According to the World Bank (2024) data, the value-added industry increased from 11 billion in 2010 to 25 billion USD in 2022. Employment in industry (as % of total employment) increased from 20% in 2000 to 24% in 2022. In 2022, the share of manufacturing in GDP reached 19%, while in 2010 and 2015 it was respectively equal to 10% and 13%. Investments in fixed capital play an important role in industrial development. According to data from the Statistics Agency under the President of Uzbekistan (2024), a share of investment in fixed capital in GDP jumped from 22.7% in 2017 to 29.1% in 2018. The maximum level of this indicator was observed in 2019 when it amounted to 36.8% (in 2022 – 30%). A share of the state budget in investments in fixed capital also increased from 4.8% in 2017 to 8% in 2022 (9.3% in 2021). A share of foreign investments and loans in investments in fixed capital show significant changes. The indicator increased from 23.8% in 2017 to 42.8% in 2022. Attraction of foreign capital for the implementation of the industrial policy can accelerate the economic transformation process and improve the competitiveness of Uzbekistan’s industrial sector.

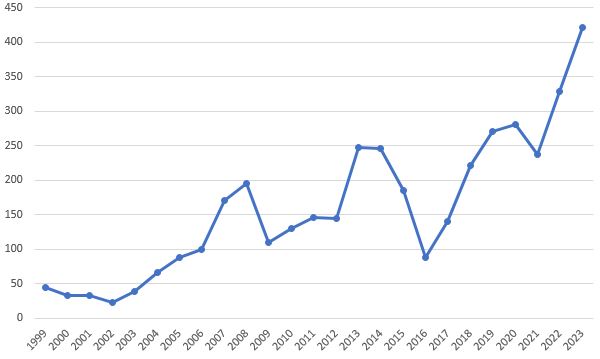

The car industry remains one of the most controversial in Uzbekistan and many experts differently assess its achievements as a result of the country’s industrial policy. Car production in Uzbekistan grew from 44 thousand in 1999 to 421 thousand in 2023, increasing by almost 10 times (Figure 1). According to Fergana Agency (2024), almost 1.7 million vehicles were sold in Uzbekistan in 2023, which is 18% more than a year earlier. As of January 1, 2024, the number of cars owned by individuals in Uzbekistan exceeded 4.02 million, of which almost 3.8 million are passenger cars. It is worth mentioning that car ownership is increasing in Uzbekistan. The indicator increased from 21 cars per 100 Uzbek households in 2010 to 57 cars in 2023.

Uzbekistan’s state-owned company UzAvtosanoat (founded in 1992) dominates the internal market. To develop the car industry, initially, Uzbekistan attracted well-known multinationals from South Korea and the United States such as Daewoo Motors and General Motors, the technology of which could help to establish the foundations of the industry. Car manufacturing is Uzbekistan’s priority industrial policy aimed at both import substitution and export promotion. Uzbekistan protects the internal market through trade policy instruments such as tariffs and regulations, provides tax preferences to the car industry, and uses monetary policy instruments to support it. UzAvtosanoat releases only a few new cars into the domestic market two or three times a year and exports most of the produced cars to the markets of CIS countries predominantly Russia and Kazakhstan at competitive prices that leave very little room for profit. Instead, most of UzAvtosanoat’s profits came from the domestic market. This situation habitually resulted in a paradox, where cars produced in Uzbekistan were more expensive on the domestic market than abroad. However, despite being a car-producing country, Uzbekistan is habitually unable to meet its domestic demand for new cars and import restrictions cause car shortages in the country (Olma, 2020). Galdini (2023) calls Uzbekistan’s policy a ‘backward form of industrialization’ where multinationals form joint ventures with small countries to receive substantial amounts of subsidies and to manufacture relatively expensive cars for the protected Uzbek market.

Figure 1. Car production in Uzbekistan, thousand

Source: Author’s compilation using data from the OICA (2024).

Uzbek independent economist Igor Tsoy criticizes the country’s auto industry for its inefficiencies, higher prices for domestic consumers, uncompetitiveness, protectionism, and monopoly-related negative effects. According to Tsoy, to increase the competitiveness of Uzbekistan’s auto industry, it is needed to reduce production costs, enter foreign markets, accelerate the process of localization and import substitution of components, parts and materials. Data on the localization level of Uzbekistan’s auto industry is controversial and varies from 22% to about 50% (Podrobno.uz, 2019).

From January 1, 2023, Uzbekistan introduced a new regulation and the sale of new imported cars was allowed not only to official dealers of manufacturers but also to other importers. After this, various companies and individuals began delivering cars from abroad – mainly from China. In 2023, Uzbekistan imported over 73 thousand cars, which is 2.4 times more than the previous year. Car deliveries from China increased 5.2 times, from 11.2 thousand in 2022 to more than 58 thousand units in 2023. Hence, in 2023 the share of China in total imports exceeded 79%. The value of imports increased to almost 1.8 billion USD, which is 2.9 times more than in 2021 (588.2 million USD). Despite higher car imports from South Korea, the United States, Germany and Japan, their share in total imports is decreasing. For instance, imports from Japan increased from 157 cars in 2022 to 419 cars in 2023 (Gazeta.uz, 2024).

From April 1, 2024 it was expected that Uzbekistan would tighten the procedure for importing cars. It was also planned to restore the procedure for selling new foreign cars through official dealers. Moreover, it became known about a possible restriction on unofficial imports of cars from the Chinese BYD. The presidential decree dated March 18 on the approval of an investment agreement on organizing the production of electric and hybrid vehicles in Uzbekistan contains a clause that the investor – the BYD company – appealed to the government of Uzbekistan to limit the disorderly import of electric vehicles without an official guarantee (Gazeta.uz, 2024). It is worth noting that Chinese automaker BYD signed an investment agreement on organizing the production of electric and hybrid vehicles and their components in Uzbekistan by creating a joint venture with Uzavtosanoat. The planned production volume at the first and second stages of the investment project will be 50 thousand and with the completion of the third stage – 300 thousand cars per year (Kapital, 2023). The heads of car dealerships selling electric vehicles in Uzbekistan appealed to the President of Uzbekistan because of restrictions on car imports. A representative of the King Motors car dealership, which mainly sells BYD electric cars, said that the head of state has made great efforts to develop a green economy and popularize electric vehicles among the population. Car dealers mention that their goods remain on the border of China or the border of Kazakhstan. The Agency for Technical Regulation recently reported that the changes were planned to be implemented on April 1, but for now, the document is in draft status, i.e. the changes have not yet come into force (Knews.kg, 2024).

Uzbekistan actively engages in industrial cooperation with other Central Asian countries. For instance, Kazakhstan and Uzbekistan are building a plant for the production of kitchen stoves, vacuum cleaners, televisions, microwaves, and washing machines of the Uzbek brand Artel in the Karaganda region. The commissioning of the plant is planned for 2025. The project is divided into several stages, and the development potential is 8.95 billion USD, of which 7.97 billion USD is for export. According to local authorities of the Karaganda region, the enterprise will produce up to a million products per year and provide jobs for about 1.200 people. It is worth mentioning the implementation of another important project such as the launch of production of small-unit assembly of Chevrolet Onix cars in the Kostanay region, which is planned for the first quarter of 2024 on the basis of the SaryarkaAvtoProm plant (Kursiv, 2023).

Thus, Uzbekistan has already achieved many goals of its initial industrial policy using well-protected markets and strong measures of state support. Currently, the country set ambitious goals for its new industrial policy, aimed at increasing competitiveness and capacity. Attraction of foreign investments, multinationals, and industrial cooperation can strengthen Uzbekistan’s economy. The government also needs to make a priority demand of Uzbek consumers and find solutions for the challenges such as monopoly in car production.

References:

Bae, Eun, Young and Jai, Mah (2018). The role of industrial policy in the economic development of Uzbekistan. Post-Communist Economies, 31 (2): 1-18.

Fergana Agency (2024). The cost of car registration in Uzbekistan has risen 68 times. Retrieved from https://fergana.agency/news/133376/. Accessed on 17.04.2024.

Galdini, Franco (2023). ‘Backward’ industrialisation in resource-rich countries: The car industry in Uzbekistan. Competition & Change, 2023, 27 (3-4): 615–634.

Gazeta.uz (2024). Car imports to Uzbekistan increased 2.4 times, from China – 5.2 times. Retrieved from https://www.gazeta.uz/ru/2024/02/06/auto-import/. Accessed on 01.04.2024.

Gazeta.uz (2024). Import of cars to Uzbekistan may be limited from April 1. Retrieved from https://www.gazeta.uz/ru/2024/03/31/auto-import/. Accessed on 14.04.2024.

Kapital (2023). They intend to launch production of electric vehicles in Uzbekistan in 2024. Retrieved from https://kapital.kz/world/121644/proizvodstvo-elektromobiley-namereny-zapustit-v-uzbekistane-v-2024-godu.html. Accessed on 10.04.2024.

Knews.kg (2024). “Entrepreneurs can turn into criminals”: Importers of electric vehicles in Uzbekistan appeal to the president. Retrieved from https://knews.kg/2024/04/11/predprinimateli-mogut-prevratitsya-v-prestupnikov-importyory-elektromobilej-uzbekistana-obratilis-k-prezidentu/. Accessed on 24.04.2024.

Kursiv (2023). Kazakhstan and Uzbekistan will complete the construction of a plant for the production of household appliances in Saran by 2025. Retrieved from https://kz.kursiv.media/2023-07-17/lgtn-householdappliances/. Accessed on 10.04.2024.

Lex.uz (2024). Decree of the President of the Republic of Uzbekistan. About the Strategy “Uzbekistan – 2030”. Retrieved from https://lex.uz/ru/docs/6600404. Accessed on 10.04.2024.

Organisation Internationale des Constructeurs d’Automobiles (2024). Production statistics. Retrieved from https://www.oica.net/production-statistics/. Accessed on 02.04.2024.

Olma, Nikolaos (2020). Monotonous motorscapes: Uzbekistan’s car industry and the consolidation of a post-socialist shortage economy, Central Asian Survey, 40 (114): 1-16.

Podrobno.uz (2019). GM Uzbekistan: power limit reached. What’s next? Retrieved from https://podrobno.uz/redactor/GM-Uzbekistan-chto-dalshe/?PAGEN_1=11. Accessed on 05.04.2024.

President.uz (na). Development Strategy of New Uzbekistan for 2022 – 2026. Retrieved from https://president.uz/ru/pages/view/strategy?menu_id=144. Accessed on 20.04.2024.

Statistics Agency under the President of Uzbekistan (2024). Industry. Retrieved from https://stat.uz/en/#. Accessed on 08.04.2024.

World Bank (2024). Uzbekistan. Retrieved from https://data.worldbank.org/country/uzbekistan. Accessed on 02.04.2024.

Note: The views expressed in this blog are the author’s own and do not necessarily reflect the Institute’s editorial policy.